Agencia 92: Your Source for Trending News

Stay updated with the latest insights and stories that matter.

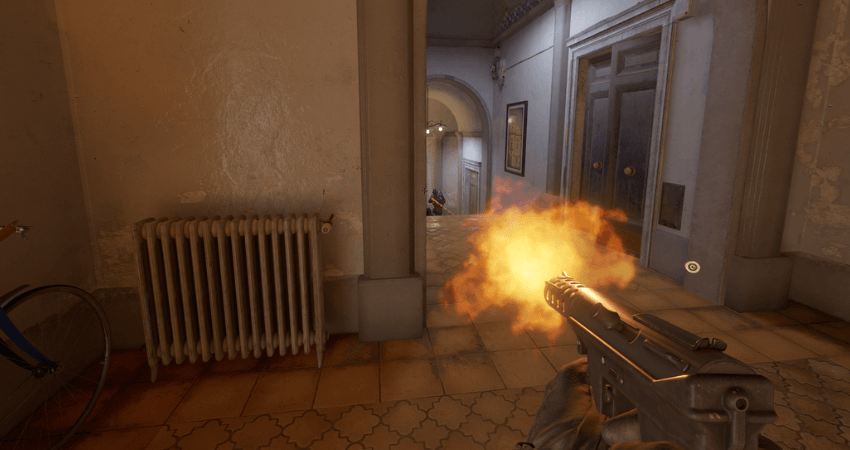

Fragging Fame: Elevate Your CS2 Game with Entry Fragging

Dominate CS2 with entry fragging tips that boost your skills and elevate your gameplay. Unlock your potential and lead your team to victory!

Understanding the Role of Entry Fraggers in CS2: Strategies for Success

In Counter-Strike 2 (CS2), the role of the entry fragger is crucial for gaining control of key areas on the map. Entry fraggers are typically the first players to enter a bomb site or engage the enemy, aiming to secure critical kills that pave the way for their team. This position requires not only exceptional aim and reflexes but also a deep understanding of game mechanics and positioning. The success of an entry fragger can set the tone for the entire round, making it vital for them to communicate effectively with their teammates to coordinate attacks and capitalize on any advantages they might have.

To excel as an entry fragger in CS2, players can adopt several strategies:

- Map Knowledge: Understanding map layouts and common enemy positions can help entry fraggers choose the best angles for engagement.

- Utility Usage: Mastering grenades and smokes can create opportunities for safe entry, blinding or flushing out enemies.

- Team Coordination: Communicating with the team about planned approaches can enhance the chances of success.

- Crosshair Placement: Maintaining a high-level crosshair placement can significantly improve reaction times against opponents.

Counter-Strike is a popular tactical first-person shooter game that has captivated millions of players worldwide. The game's competitive nature and strategic depth make it a favorite in the esports scene. Players can enhance their experience through various features, such as dmarket case opening, allowing them to acquire new skins and customize their weapons.

Top 5 Tips to Improve Your Entry Fragging in CS2

Improving your entry fragging in CS2 is essential for gaining the upper hand in competitive matches. Here are the Top 5 Tips that can help refine your skills:

- Learn the Maps: Familiarize yourself with each map’s layout, including common hiding spots and chokepoints. This knowledge will allow you to anticipate enemy positions and make informed decisions.

- Use Utility Wisely: Mastering the use of grenades, flashes, and smokes can give you a significant advantage. Throwing a well-timed flashbang can blind enemies, allowing you to secure those crucial entry frags.

- Crosshair Placement: Maintain your crosshair at head level and pre-aim common angles where enemies might be positioned. This reduces reaction time and increases the likelihood of scoring a quick elimination.

- Communicate with Your Team: Call out enemy positions and coordinate your attacks. Effective communication can create opportunities for successful entry fragging.

- Practice, Practice, Practice: Regularly play deathmatches or aim training maps to enhance your aim and reflexes. Consistent practice is key to mastering the skills needed for effective entry fragging in CS2.

Common Mistakes Entry Fraggers Make and How to Avoid Them

Entering the world of trading can be exhilarating, but many entry fraggers make common mistakes that can hinder their success. One prevalent mistake is overtrading, where traders execute too many trades in a short period, often driven by emotions or the fear of missing out. This not only increases transaction costs but can also lead to significant losses. To avoid this pitfall, it is essential to develop a disciplined trading strategy and adhere to it, setting clear criteria for when to enter and exit trades.

Another common mistake is neglecting proper risk management. Many entry fraggers fail to define their risk tolerance and do not set stop-loss orders, which can result in unexpectedly high losses. It is crucial to assess each trade's risk-to-reward ratio and only invest a small percentage of your capital in a single trade. To mitigate risks effectively, consider implementing position sizing strategies and always review your trades to learn from both victorious and unsuccessful outcomes.