Agencia 92: Your Source for Trending News

Stay updated with the latest insights and stories that matter.

Life Insurance: The Invisible Shield You Never Knew You Needed

Discover why life insurance is the invisible shield that protects your loved ones—uncover the must-know truths you never knew!

What is Life Insurance and Why is it Essential for Everyone?

Life insurance is a financial product designed to provide protection to your loved ones in the event of your untimely demise. By paying regular premiums, you secure a policy that pays out a predetermined sum to your beneficiaries upon your death. This financial safety net can cover a variety of expenses such as funeral costs, outstanding debts, and ongoing living expenses, allowing your family to maintain their lifestyle during a challenging time. Life insurance ensures that your family is not left with financial burdens when they are already dealing with emotional loss.

Understanding why life insurance is essential for everyone is crucial. First and foremost, it provides peace of mind, knowing that your family's financial future is safeguarded. Additionally, life insurance can serve as a valuable tool for wealth building and financial planning. For instance, certain policies accumulate cash value over time, which can be borrowed against or withdrawn for emergencies. Moreover, having a life insurance plan in place is often a critical component of a comprehensive financial strategy, ensuring that you are prepared for unforeseen circumstances that could impact your family's security.

The Benefits of Life Insurance: How It Protects Your Loved Ones

Life insurance serves as a vital safety net for your loved ones, ensuring their financial security in the event of your unexpected passing. One of the primary benefits of having life insurance is that it provides a death benefit to your beneficiaries, allowing them to maintain their standard of living and cover essential expenses such as mortgage payments, education costs, and daily living expenses. This peace of mind not only protects your family from financial burdens but also allows you to focus on what truly matters—creating lasting memories with your loved ones.

Additionally, life insurance can help cover funeral expenses, which can be a significant financial strain on families during an already challenging time. By having a policy in place, you not only ease the emotional burden but also prevent your family from incurring debt. Furthermore, some life insurance policies also offer a cash value component, which can be borrowed against for emergencies or invested for future growth. In short, investing in life insurance is a proactive step towards safeguarding your family’s future and ensuring they are well taken care of.

Top 5 Myths About Life Insurance Debunked

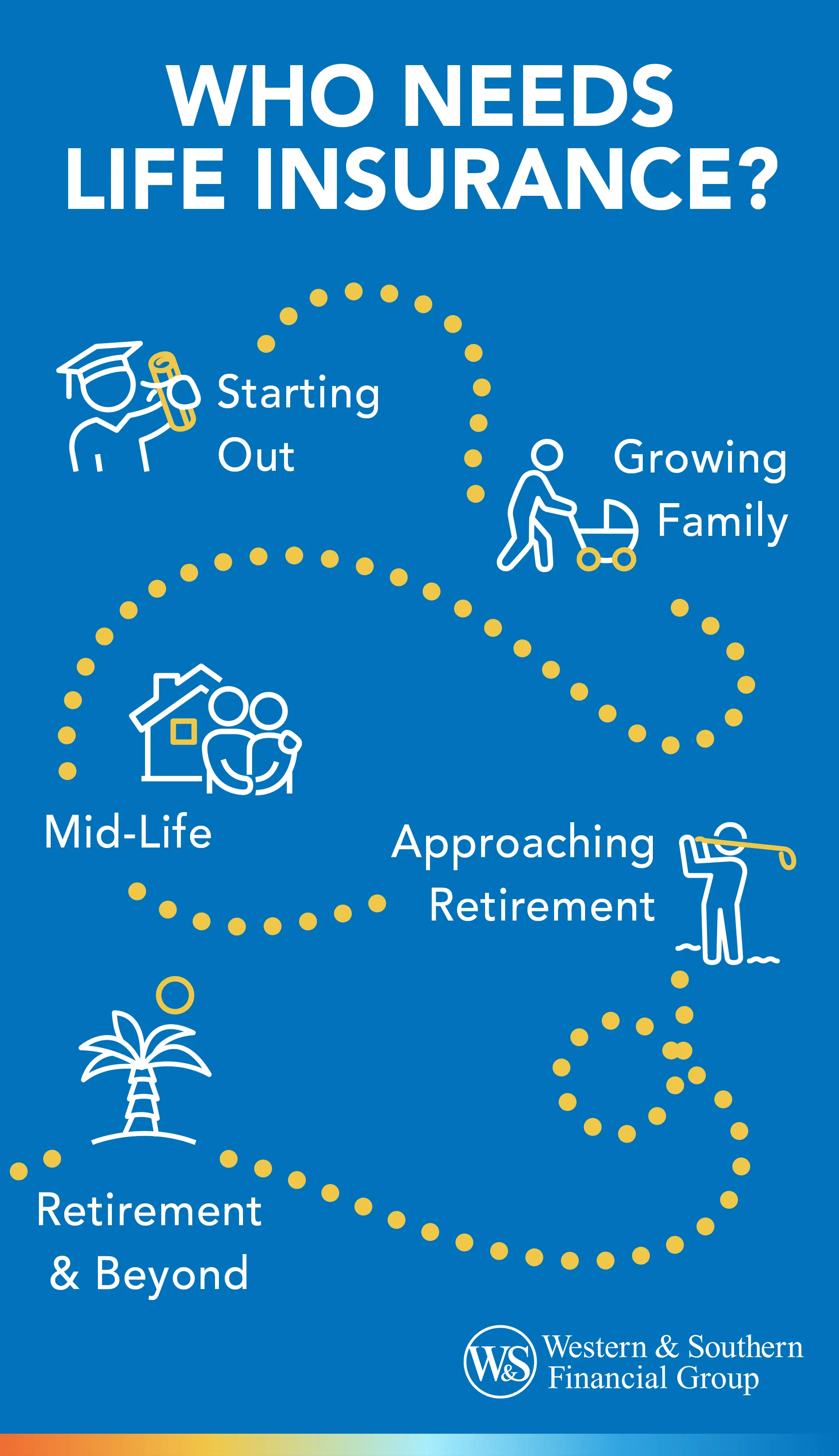

When it comes to life insurance, many people hold misconceptions that can prevent them from making informed decisions. One prevalent myth is that life insurance is only necessary for those with dependents. In reality, even individuals without children or spouses can benefit from a policy, as it can cover debts, funeral costs, and provide peace of mind. Additionally, some believe that life insurance is too expensive, but there are a variety of plans available to suit different budgets, making it accessible for most people.

Another common myth is that life insurance is only for older adults. Many young adults overlook this crucial financial tool, believing they have plenty of time to consider it later. However, purchasing life insurance at a younger age can result in lower premiums and better coverage options. Lastly, some individuals think they will be unable to get insurance due to pre-existing health conditions. Fortunately, many insurers offer options for those with health issues, debunking the myth that coverage is universally unattainable.