Agencia 92: Your Source for Trending News

Stay updated with the latest insights and stories that matter.

Why Your Landlord's Insurance Won't Save You (And What Will)

Discover why landlord insurance may fail you and uncover essential tips to protect your investment. Don't risk it—read more now!

The Truth About Landlord's Insurance: What You're Not Being Told

Landlord's insurance is often portrayed as a safety net for property owners, but many landlords are unaware of the critical nuances that come with these policies. For instance, while standard policies cover property damage and liability, they may not protect against specific risks like tenant vandalism, loss of rental income, or even legal fees related to eviction processes. Additionally, some landlords mistakenly believe that their homeowner's insurance will suffice when renting out their property, which can lead to significant financial losses in the event of a claim. Understanding the full scope of coverage is essential for safeguarding your investment.

Another common misconception is that the cost of landlord's insurance is prohibitively expensive. However, by comparing policies and understanding the factors that influence premiums, such as location, type of property, and the tenant screening process, many landlords find that affordable options are available. It's also worth noting that certain insurers offer discounts for multi-property coverage or for implementing safety features, such as security systems. Ultimately, being informed about the realities of landlord insurance can empower property owners to make smart, strategic decisions that protect their financial interests.

5 Common Myths About Landlord's Insurance Debunked

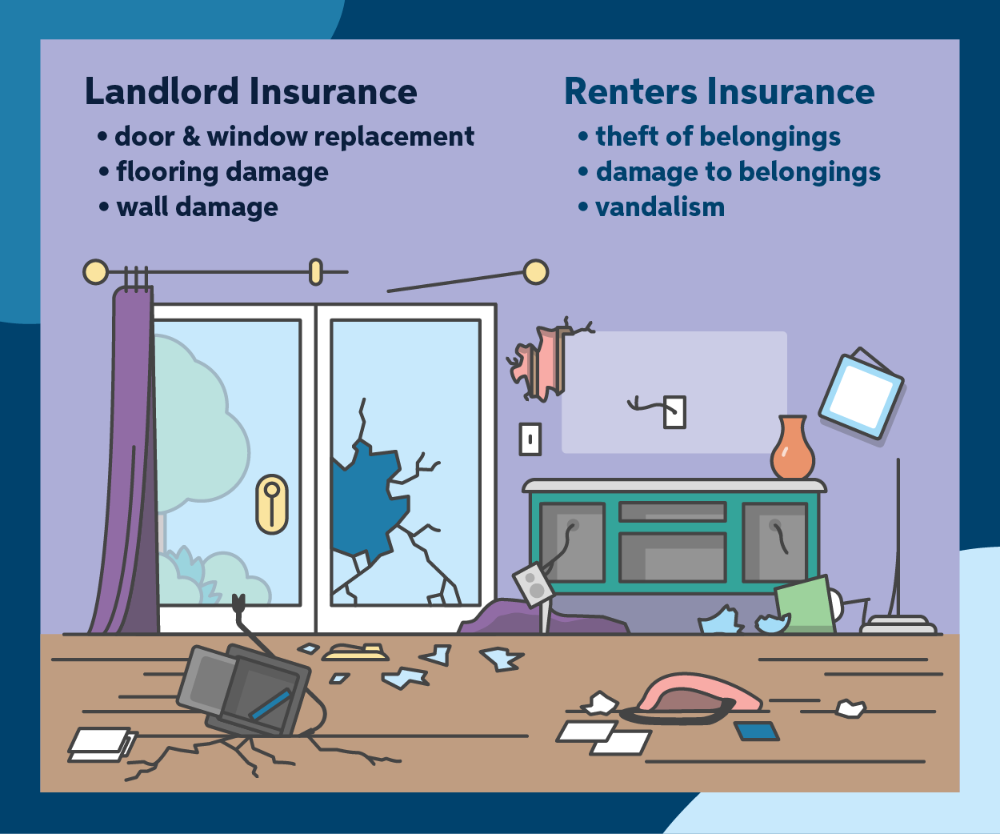

When it comes to landlord's insurance, many misconceptions exist that can potentially lead property owners to make ill-informed decisions. One common myth is that landlord's insurance is the same as regular homeowner's insurance. In reality, these two types of policies are designed for different purposes. While homeowner's insurance covers personal residences, landlord's insurance specifically caters to the unique risks associated with rental properties, providing essential coverage for liability, property damage, and loss of rental income.

Another prevalent misconception is that purchasing landlord's insurance is optional. However, many landlords do not realize that most mortgage agreements require this type of insurance to protect both the property and the lender's investment. Additionally, without adequate coverage, landlords risk significant financial loss in situations such as tenant-related damages or unexpected crises. Addressing these myths is crucial for property owners to ensure they are adequately protected and not exposed to unnecessary risks.

What Coverage Do You Really Need Beyond Landlord's Insurance?

While landlord's insurance provides a solid foundation for protecting your rental property, it often doesn't cover everything that could affect your investment. Beyond the basics of property damage and liability, consider adding an umbrella policy, which offers additional liability coverage. This can be crucial if a tenant or visitor suffers an injury on your property and the damages exceed the limits of your landlord's policy. Additionally, reevaluate the need for coverage against specific risks such as flood or earthquake, as these are typically not included in standard plans.

Furthermore, you may want to invest in loss of rental income coverage. If unexpected circumstances, like severe weather or damage, force you to temporarily halt renting, this insurance can replace lost income during repairs. Another critical option is tenant screening insurance, which can help protect against financial losses due to tenant defaults. By reviewing these additional coverages, you can ensure that you are adequately protected against a variety of risks associated with being a landlord.