Agencia 92: Your Source for Trending News

Stay updated with the latest insights and stories that matter.

Insurance Showdown: Finding the Best Bang for Your Buck

Uncover unbeatable insurance deals! Join the Insurance Showdown and discover how to get the most value for your money today!

Top 5 Insurance Factors to Consider for Maximum Value

When evaluating insurance policies, it's crucial to consider several key factors that can significantly impact the value you receive. First and foremost, coverage limits are essential; they determine the maximum amount your insurer will pay in the event of a claim. Next, consider your deductible, which is the amount you'll need to pay out-of-pocket before your insurance kicks in. A higher deductible often means lower premiums, but it's important to ensure you can afford the deductible in case of an unexpected incident. To learn more about the balance between premiums and deductibles, visit Investopedia.

Another crucial factor to consider is policy exclusions. These are specific situations or circumstances that your policy does not cover, and understanding them can save you from unpleasant surprises later on. Additionally, look into customer reviews and ratings of the insurance provider; companies with a good reputation for customer service often provide a better experience when you file claims. Finally, don't forget to check for potential discounts based on your circumstances, such as bundling home and auto insurance. For more insights into maximizing insurance value, check out NerdWallet.

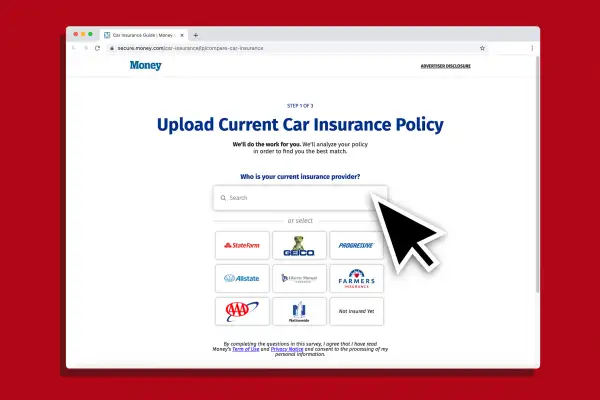

How to Compare Insurance Policies Without the Confusion

Comparing insurance policies can often feel overwhelming due to the plethora of options available. To make the process easier, start by identifying your specific needs. Consider factors such as coverage amounts, premiums, deductibles, and exclusions. You can utilize comparison tools online that allow you to input your requirements and receive tailored options. This step helps to narrow down policies that suit your lifestyle and budget.

Once you have your list of potential policies, it's crucial to examine the fine print. Look for any hidden fees, limits on coverage, or conditions that could affect your claims. You should also read customer reviews and claim experiences to get an idea of the insurer's reputation. Websites like Consumer Reports offer valuable insights into various insurance companies, making it easier to assess their reliability and service quality.

Is It Worth It? Understanding the Cost vs. Coverage Debate

When considering whether insurance is worth it, many individuals grapple with the cost vs. coverage debate. On one hand, premium costs can significantly impact your monthly budget, making it essential to evaluate whether the benefits outweigh these expenses. For example, understanding the specifics of your policy, such as coverage limits, deductibles, and exclusions, can help you ascertain whether the price you pay aligns with the protection you receive. To better understand insurance costs, explore resources like Investopedia.

On the other hand, the potential financial repercussions of inadequate coverage can be substantial. A comprehensive policy may seem pricey, but it can ultimately safeguard you against overwhelming costs in the event of an accident or disaster. It's crucial to conduct thorough research and weigh your options, looking for plans that offer a balance of affordability and adequate coverage. Sites such as ValuePenguin provide valuable insights into comparing insurance providers, helping you make an informed decision before committing to a policy.