Agencia 92: Your Source for Trending News

Stay updated with the latest insights and stories that matter.

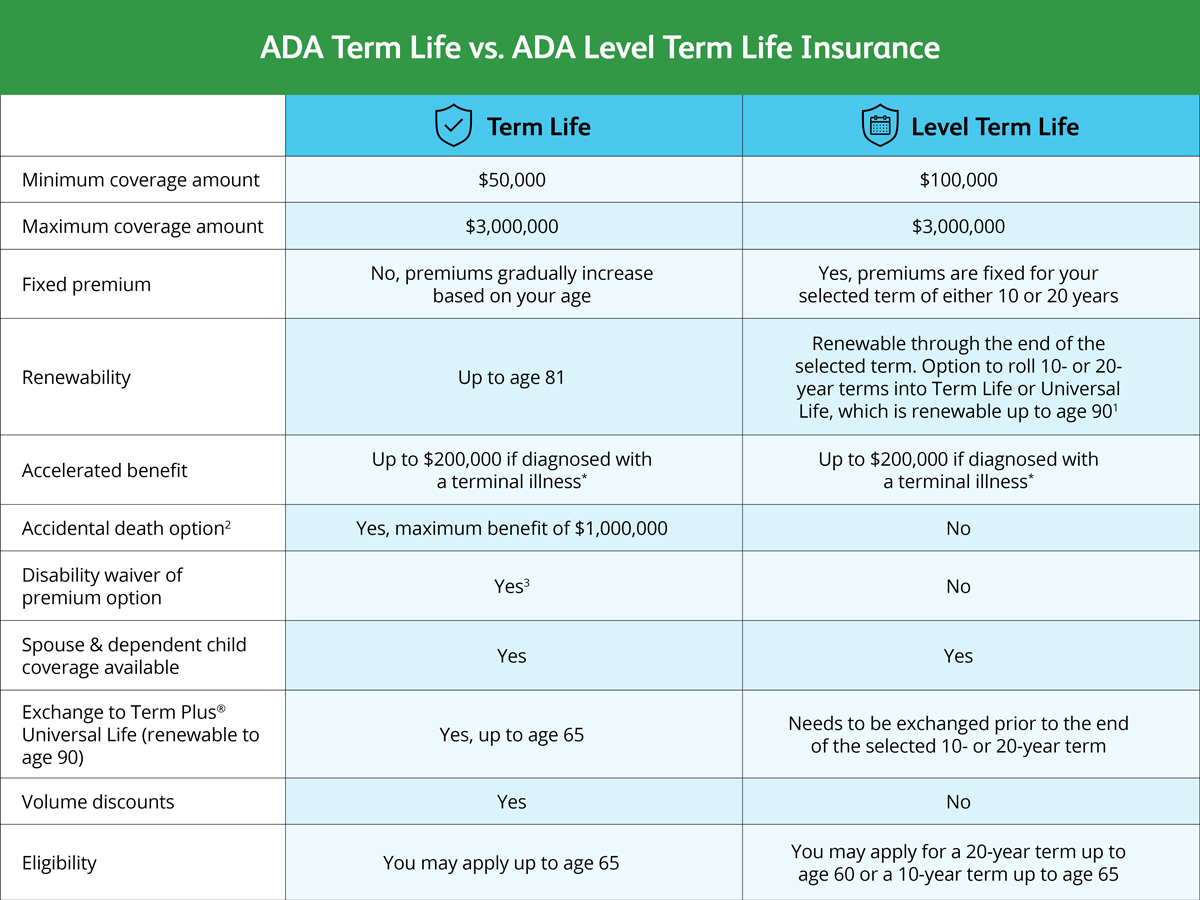

Term Life Insurance: Your Safety Net for Life's Unexpected Twists

Discover how term life insurance can protect your loved ones when life surprises you. Secure your peace of mind today!

What is Term Life Insurance and How Does It Work?

Term life insurance is a type of life insurance policy that provides coverage for a specified period, typically ranging from 10 to 30 years. If the insured passes away during this term, the policy pays a death benefit to the designated beneficiaries. Unlike permanent life insurance, which accumulates cash value over time, term life is generally more affordable and straightforward, making it an attractive option for individuals seeking financial protection for their loved ones without the complexities of whole life policies.

Here’s how term life insurance works:

- Once you purchase a policy, you select the term length and the death benefit amount.

- You pay monthly or annual premiums throughout the term.

- If you pass away within the term, your beneficiaries receive the death benefit.

- If you outlive the term, the coverage ends, and there is no payout.

This structure makes term life insurance a practical choice for those wanting to cover specific financial responsibilities, such as mortgage payments or children's education, during critical years.

5 Reasons Why You Need Term Life Insurance Today

Term life insurance is a crucial financial tool that offers peace of mind for individuals and families alike. Here are 5 reasons why you should consider securing a policy today:

- Affordable Premiums: Term life insurance typically comes with lower premiums compared to permanent life insurance, making it accessible for most budgets.

- Flexible Coverage Options: You can choose a term length that suits your needs, whether it's 10, 20, or even 30 years, ensuring your loved ones are protected during critical financial periods.

- Simple and Straightforward: The application process is generally easier and quicker, with fewer complexities than other types of insurance.

- Financial Security for Dependents: In the unfortunate event of your passing, the death benefit provides crucial financial support to your loved ones, helping cover expenses such as mortgages, education, or daily living costs.

- Peace of Mind: Knowing that you have taken steps to protect your family’s financial future allows you to focus on the present without the looming worry of what would happen if you were no longer there.

In summary, obtaining term life insurance is a proactive step towards safeguarding your family’s financial security. With its affordability, flexibility, and peace of mind, there's never been a better time to invest in this essential protection. Don’t wait until it’s too late; explore your options today!

Term Life vs. Whole Life: Which Policy is Right for You?

When choosing between Term Life and Whole Life insurance, it’s essential to understand the fundamental differences between the two policies. Term Life insurance provides coverage for a specific period, usually ranging from 10 to 30 years. This type of policy is typically more affordable, making it an attractive option for those who want insurance during critical financial years, such as while raising children or paying off a mortgage. On the other hand, Whole Life insurance offers lifelong coverage and accumulates cash value over time, making it more expensive upfront. Understanding your financial goals and long-term needs is crucial in determining which policy aligns best with your situation.

To decide whether Term Life or Whole Life is right for you, consider the following factors:

- Duration of Coverage: How long do you need coverage? If it's temporary, Term may be best.

- Budget: Can you afford the higher premiums of Whole Life?

- Investment Goals: Are you looking for a policy that builds cash value?

- Family Needs: What are your dependents’ financial needs if you were to pass away?

By weighing these considerations, you can make a more informed decision that reflects your personal financial strategy.